The 20-5-1 Rule: How Top Investors Structure Their Weekly Dealflow

You can't manage what you don't measure. And most investors aren't measuring the right things.

Ask most real estate investors how their week went, and you'll get vague answers. "Pretty good." "Made some calls." "Sent out some offers."

Ask them for numbers? Silence.

This is the first discipline of The Mantis Method: Dealflow Discipline. It's built on a simple framework we call the 20-5-1 Rule.

The Math Behind Consistent Deals

Here's the reality of real estate investing that nobody talks about: it's a numbers game with predictable ratios. Once you understand the math, the mystery disappears.

The 20-5-1 Rule breaks down like this:

| Metric | Weekly Target | What It Means |

|---|---|---|

| Contacts | 20 | New leads you reach out to |

| Conversations | 5 | Meaningful two-way discussions |

| Offers | 1 | Written offers submitted |

Twenty contacts. Five real conversations. One offer out. Every single week.

Do this consistently, and you'll close deals. Skip weeks, fudge the numbers, or focus on the wrong activities, and you'll wonder why your pipeline is empty.

Why These Specific Numbers?

The 20-5-1 ratio isn't arbitrary. It's based on real conversion rates in off-market real estate:

- 25% Contact-to-Conversation Rate: Out of 20 new contacts, roughly 5 will result in actual conversations. The rest are wrong numbers, voicemails, or "not interested."

- 20% Conversation-to-Offer Rate: Of those 5 conversations, about 1 will have enough motivation and equity to warrant an offer.

- 10-20% Offer-to-Close Rate: Submit 4-5 offers per month, close 1 deal.

This means: 80 contacts → 20 conversations → 4 offers → 1 deal per month.

Want two deals a month? Double the activity. The math scales linearly.

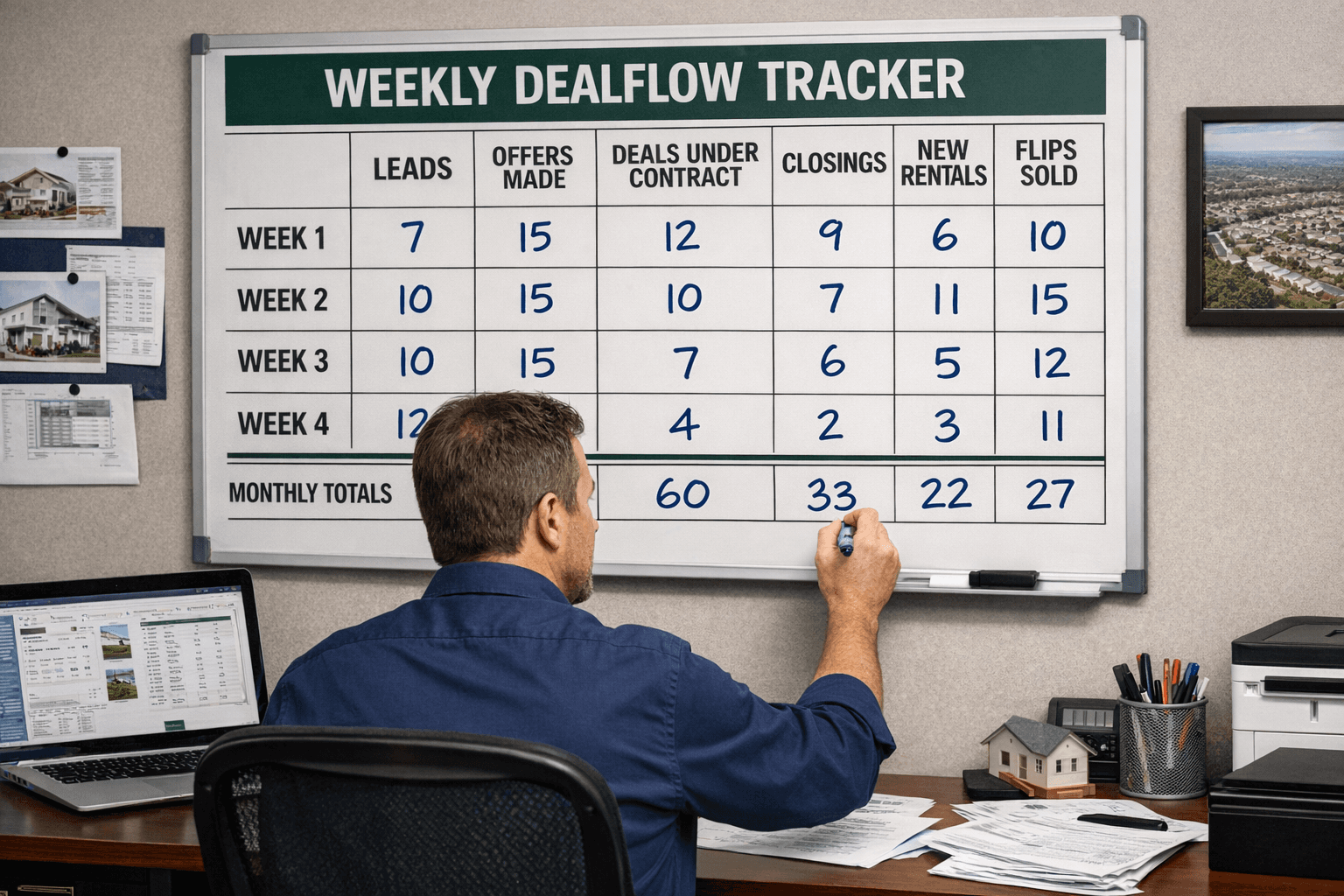

The Weekly Scoreboard

The 20-5-1 framework only works if you track it. Every week. No exceptions.

Your scoreboard should capture:

| Activity | What Counts | What Doesn't Count |

|---|---|---|

| Contacts | Cold calls, texts, door knocks, direct mail responses | Sending mail (that's marketing, not contact) |

| Conversations | Two-way dialogue about their property | Voicemails, one-word replies, "wrong number" |

| Offers | Written offer with price, terms, sent to seller | Verbal ballparks, "I'll send something over" |

Be honest with yourself. Inflating numbers only hurts you.

The Level System

Not everyone starts at 20-5-1. If you're brand new or part-time, that might be too aggressive. If you're scaling, it might be too easy.

The Mantis Method uses a level system to match your targets to your capacity:

| Level | Contacts | Conversations | Offers | Best For |

|---|---|---|---|---|

| Starter | 10 | 3 | 1 | Part-time investors, beginners |

| Standard | 20 | 5 | 1 | Full-time investors |

| Pro | 35 | 8 | 2 | High-volume operators |

| Elite | 50 | 12 | 3 | Teams, acquisitions managers |

Start at a level you can sustain. Consistency beats intensity. A Starter who hits their numbers every week will outperform a Pro who hits their numbers once a month.

Common Mistakes

1. Counting the Wrong Things

Sending 100 text blasts isn't 100 contacts. A contact is when you actually reach someone. Don't confuse activity with progress.

2. Skipping Offer Week

Many investors have great weeks of calls and conversations, then never submit offers. The offer is the only activity that can result in a deal. Everything else is just setup.

3. Inconsistency

A monster week followed by two weeks of nothing is worse than steady, modest activity. Pipeline momentum matters. Leads go cold. Motivation fades. Consistency keeps opportunities warm.

4. Not Tracking

If you're not writing it down, you're guessing. Guessing leads to false confidence or unnecessary panic. Track every week, review monthly, adjust quarterly.

How FlipMantis Tracks This For You

The FlipMantis Dealflow Scoreboard automates the 20-5-1 tracking:

- Weekly logging: Quick entry for contacts, conversations, and offers

- Level selection: Choose your tier and see targets adjust automatically

- Progress visualization: See exactly where you stand against your weekly goals

- Historical trends: Review past weeks to identify patterns

- Streak tracking: Build momentum with consecutive successful weeks

No spreadsheets. No guessing. Just a simple system that tells you exactly where you stand.

Start This Week

You don't need software to start. Grab a notebook. Write down three columns: Contacts, Conversations, Offers. Set your targets. Track daily. Review weekly.

The 20-5-1 Rule works because it forces accountability. It removes the guesswork. It tells you exactly whether you're doing enough activity to hit your goals.

Most investors who "aren't finding deals" simply aren't doing enough activity. The 20-5-1 Rule makes that impossible to ignore.

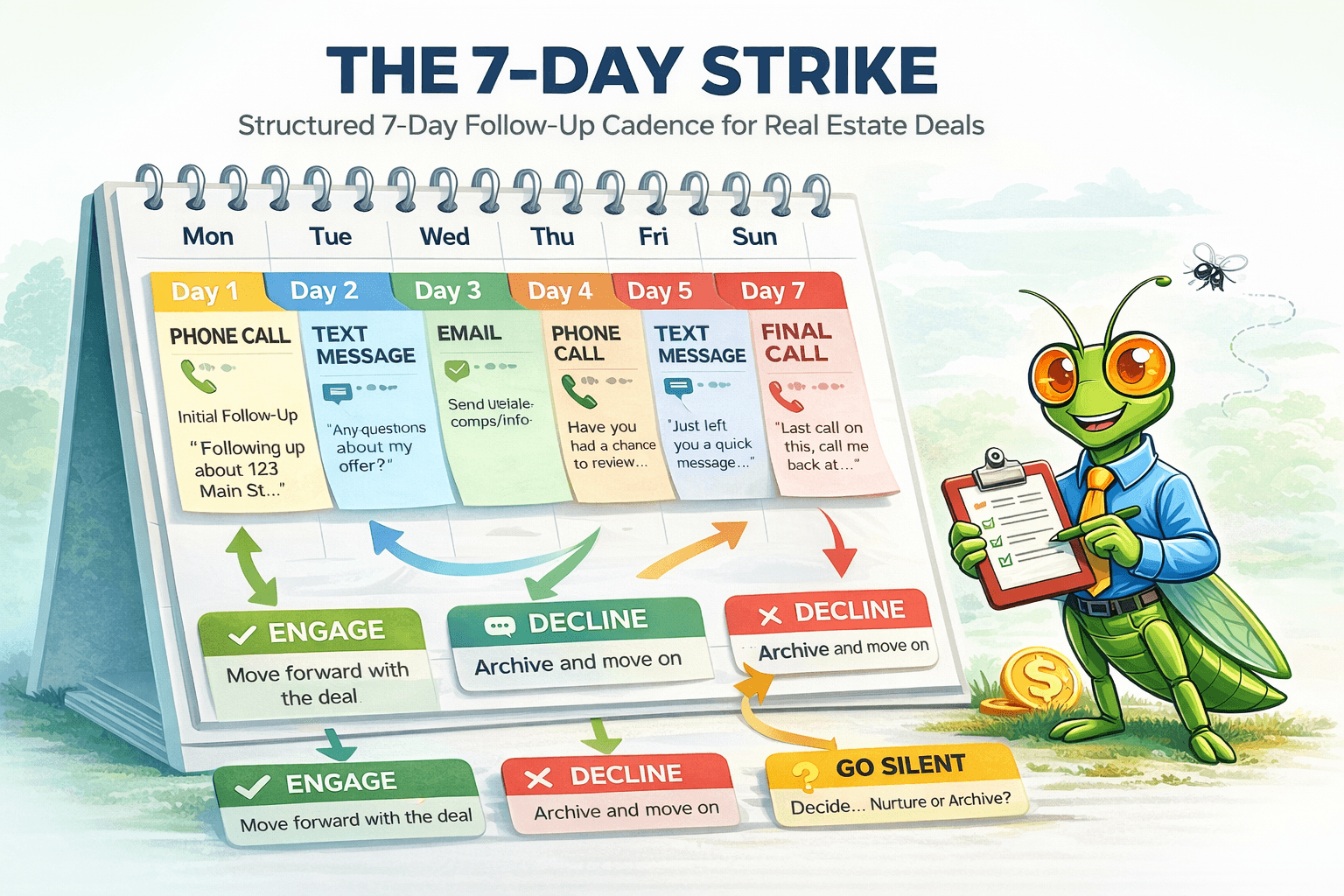

The 20-5-1 Rule is the first discipline of The Mantis Method. It handles pipeline activity. But activity without follow-up is wasted effort. That's where the 7-Day Strike comes in.

Get The Complete Mantis Method Playbook

Download the free PDF guide with all three disciplines, weekly tracking templates, and the complete system for consistent deal flow.

Available on The Mantis Method page.